True" Hello, my name is Katie C Norris with CNRS Wealth Management. In this video, we're going to learn how to fill out Form W-4. Let's get going! First, if you need to locate Form W-4 in case your employer didn't provide you with one, you can go to the search browser of your choice and type in W-4. You will see the irs.gov website, and it will say "Form W-4 - Employees Withholding Certificate." That's the official name for Form W-4. The form was updated in 2020, and the changes were significant. After you click on the form, you will see four pages. The form itself is only page number one. The rest of the pages will include instructions and worksheets. You can download this form and fill it out on your computer, and then print it out. Alternatively, you can print it out and fill it out by hand. But again, depending on your employer, you're probably going to receive one at your place of employment. Let's get to the form, called "Employees Withholding Certificate." The form consists of five steps. Only Step 1, which is your personal information, and Step 5 are mandatory. Steps 2, 3, and 4 are optional. Step number one is your personal information. You will have to fill out your first name, middle initial, and last name. You have to provide your social security number. If you want to make sure that your name matches the name on your social security card, they actually provide you with a phone number you can call to confirm. Then, you have to provide your home address, including the street house number or apartment, city, state, and zip code. In Section C, you will have to pick your filing status, your tax filing status. If you don't know, you can refer to your...

Award-winning PDF software

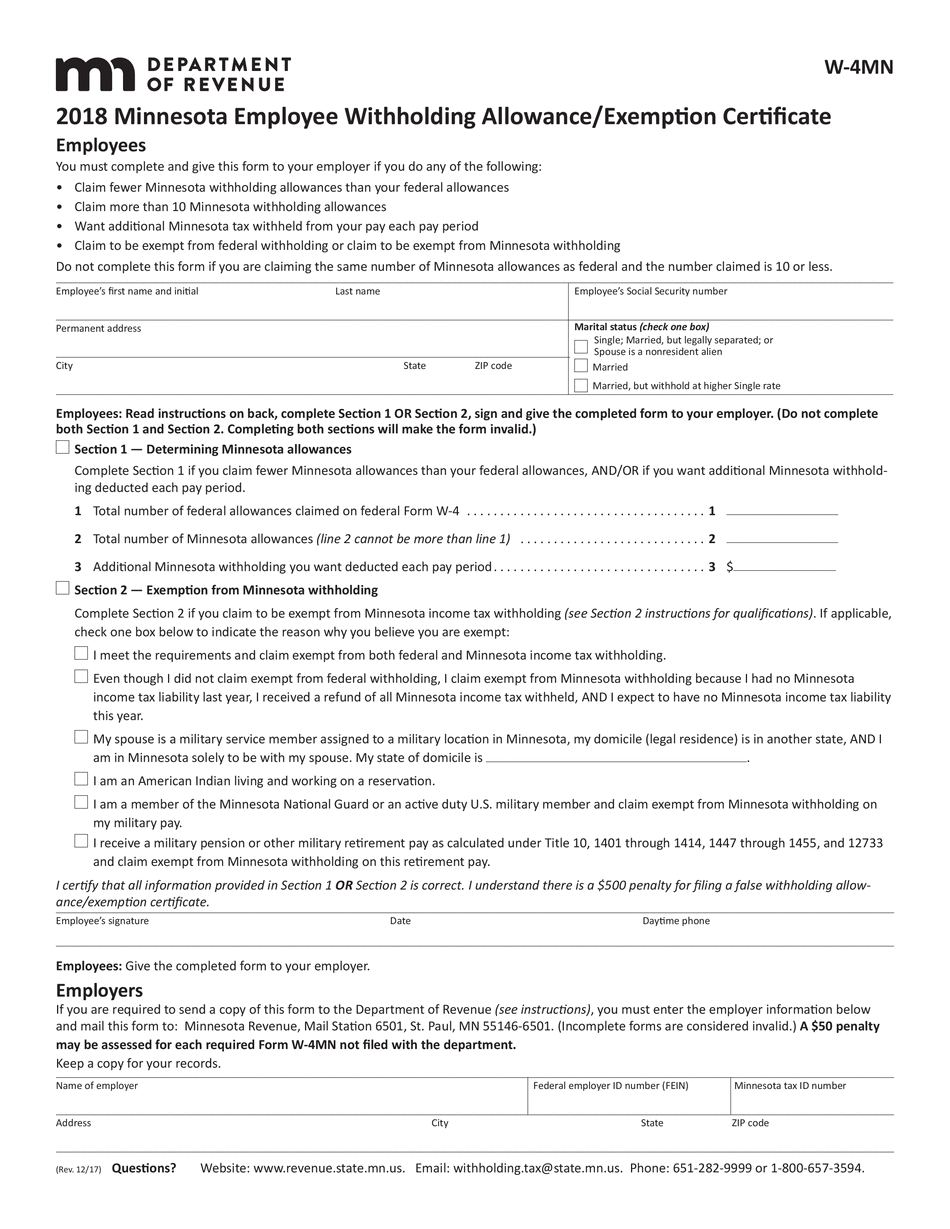

Video instructions and help with filling out and completing Minnesota Form W-4MN