True" Laws Dot-Com Legal Forms Guide Form K-40: Kansas Individual Income Tax Kansas residents, part-year residents, and non-residents file their state income tax using Form K-40. This document can be found on the website of the Kansas Department of Revenue. Step 1: In the top left-hand corner, provide your name, your spouse's name (if filing jointly), mailing address, school district number, and county abbreviation. Step 2: If your name or address has changed since your last return or your spouse passed away during the previous tax year, mark an "X" in the designated areas. Step 3: In the top right-hand corner, write the first four letters of your last name and your social security number in capital letters. Do the same for your spouse (if filing jointly). Also, include your daytime telephone number. Step 4: If you are filing an amended return, indicate whether the amendments only affect your Kansas returns, if you have filed an amended federal return, or if you are filing an amended return due to an IRS audit. Step 5: Check the appropriate to indicate your filing status. Step 6: Check the appropriate to indicate your residency status. Step 7: Note the total number of exemptions claimed. If claiming dependents, provide their names, dates of birth, relationship to you, and social security numbers. Step 8: The bottom of the page contains a food sales tax qualification section, which is only applicable to full-year residents eligible for a refund. Step 9: Document your income as instructed on lines 1 through 3. Step 10: Document your deductions on lines 4 through 7. Calculate your taxes as instructed on lines 8 through 12. Step 11: Document your credits on lines 13 through 17. Also, report any use tax owed on lines 18 and 19. Step 12: Document taxes withheld from wages and payments made on lines 20 through 27. Calculate your...

Award-winning PDF software

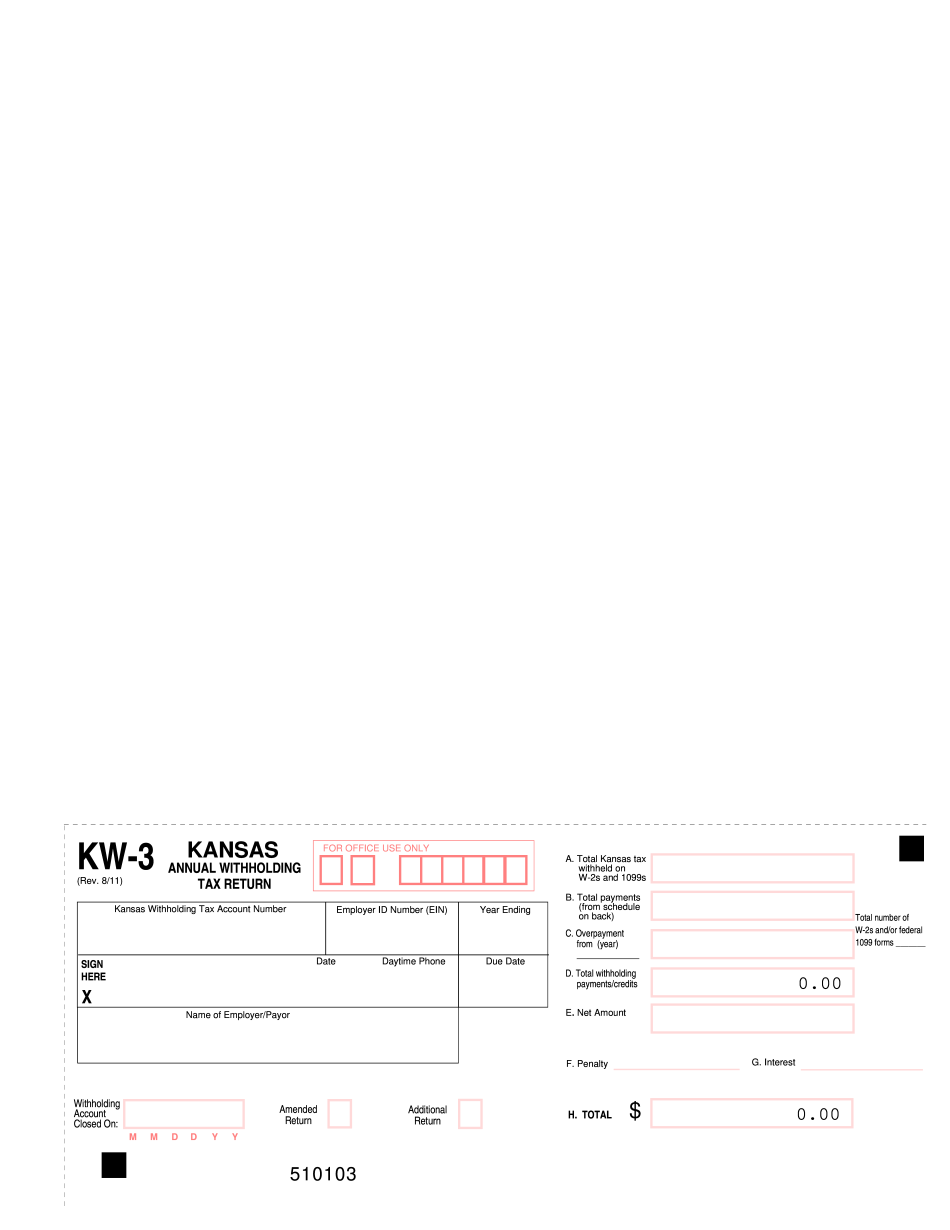

Video instructions and help with filling out and completing KW-3 Form KS