True" Good morning and welcome to your farm and home show. My name is Joanna Coles and this morning we're visiting with Kevin Lyons. He's the Monroe County Extension Agent for Agriculture and Natural Resources. Good morning, Kevin. Good morning, Joanna. Now Kevin, we get calls at the Extension office all the time about farm tax exemption and those types of things, but we have something new this year to tell people. We do. There's a new law that just went into effect, I think July 1st, 2021. It was passed about a year ago, but it's just like most laws, it takes a little lag time for it to take effect. But it will take full effect January 1st, 2022. And it's where farmers and ag producers need to have an ag exemption number in order to always get that sales tax exemption on their purchases that qualify for that. Alright, so in years past, they would fill out a form and take that to their retailer. But now they have to actually send in a form to the Department of Revenue, right? Yes, they have to. The initiative has kind of been passed over to the farmer and taken some of the load off for the businesses and vendors. It brings on a little bit more accountability and keeps things streamlined. There's been a little bit of issue maybe in the past where there's some confusion on what was exempt and what wasn't exempt, and maybe some things got counted that shouldn't have been. So they're trying to straighten that up just a little bit. Is the main goal of this, but it also puts the onus on the farmer to take care of that. So they need to be aware that that's coming, and that's what we're...

Award-winning PDF software

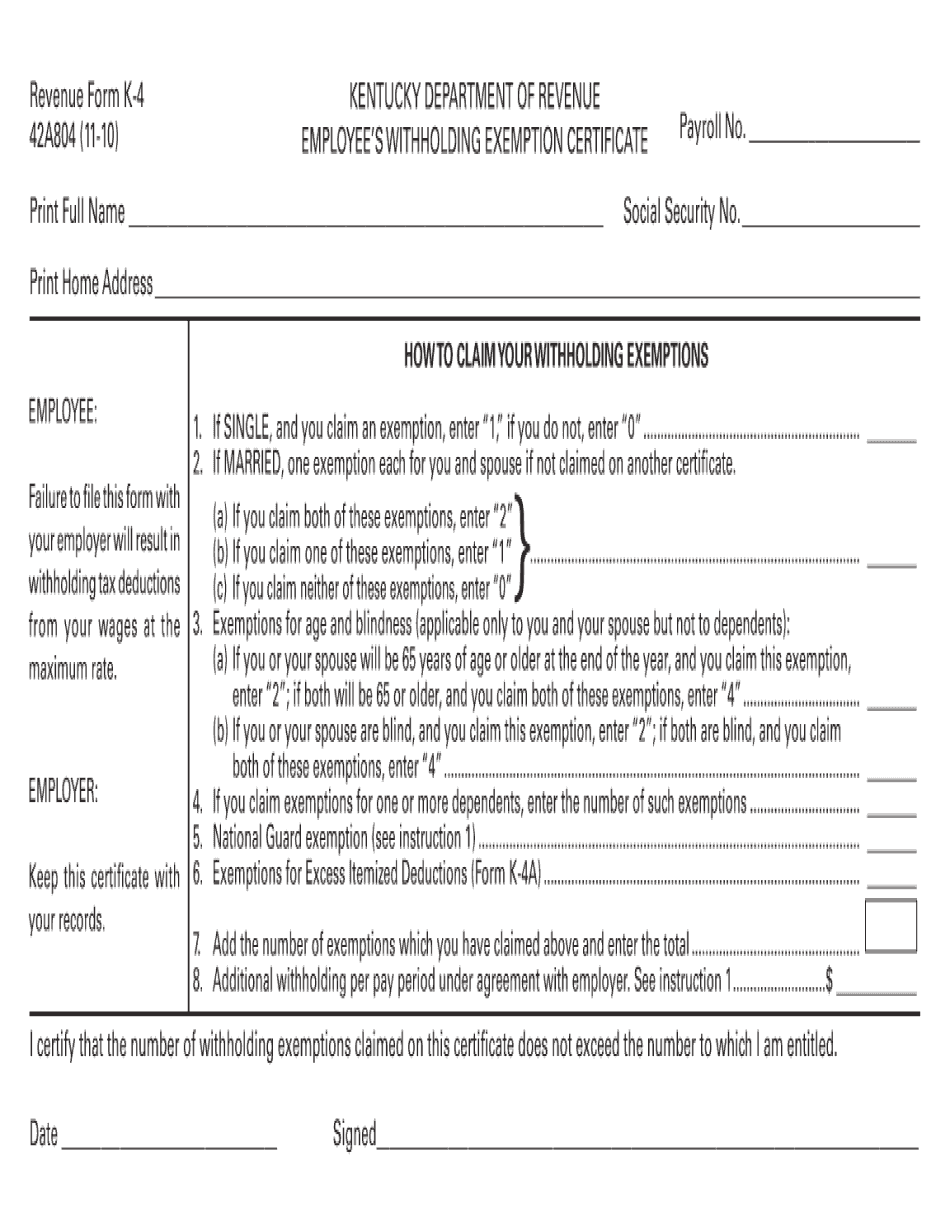

Video instructions and help with filling out and completing Revenue Form K 4